library(tidyverse)

library(lubridate)

library(scales)

library(ggplot2)TidyTuesday: 2025 Market Events - S&P500 vs Nikkei 225

Overview

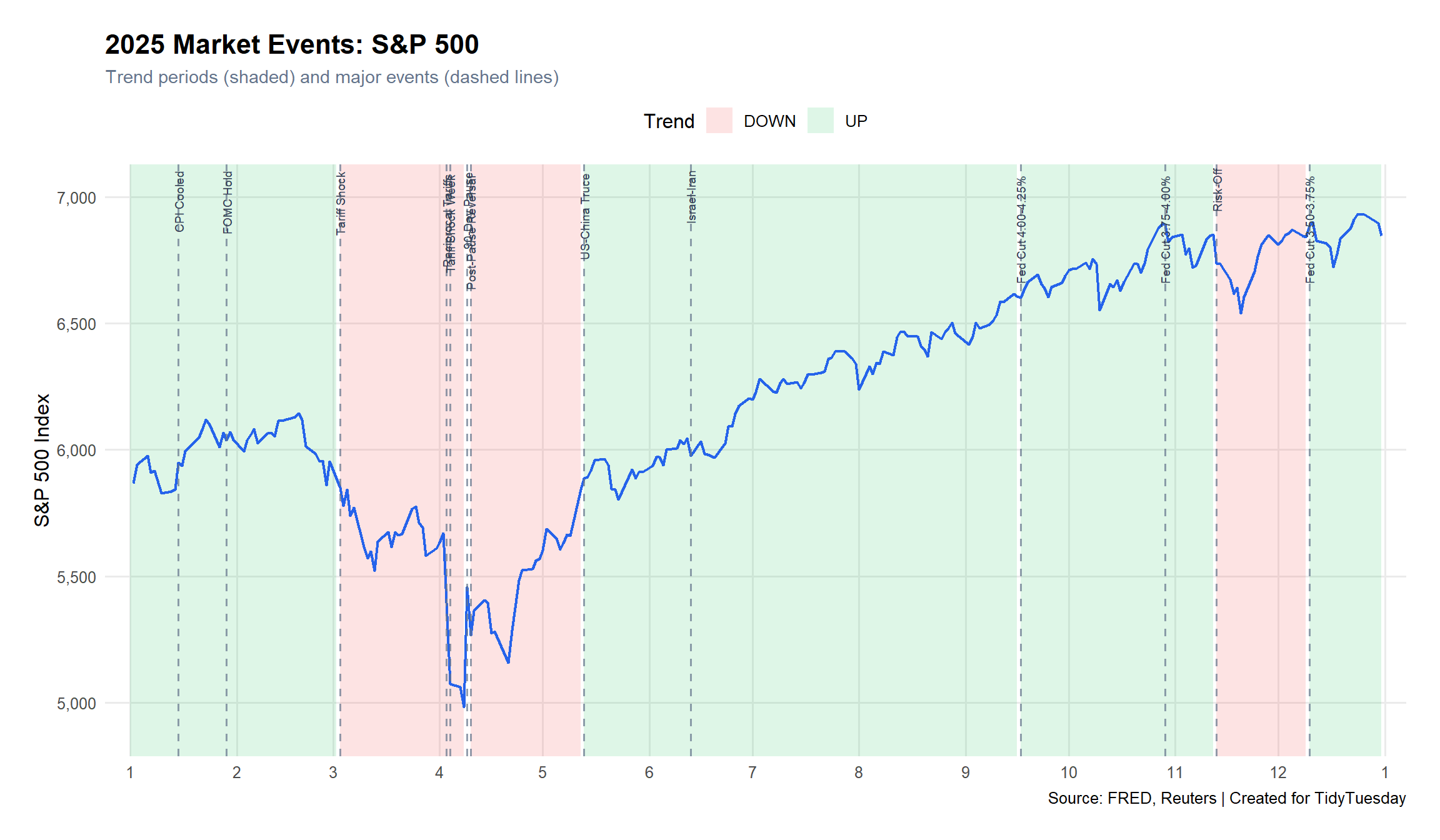

This week’s TidyTuesday explores the major market events of 2025, visualizing how the S&P 500 and Nikkei 225 responded to key events like tariff announcements, Fed rate decisions, and geopolitical tensions.

The visualization features:

- Dual-axis line chart: S&P 500 and Nikkei 225 normalized for comparison

- Trend shading: Green for uptrends, red for downtrends

- Event markers: Vertical lines marking significant market events

Dataset

Source: Custom dataset compiled from Reuters, FRED, and market data

# Load market events data

# Navigate up from quarto folder to project root

base_path <- here::here()

# If running from quarto folder, go up to project root

if (!dir.exists(file.path(base_path, "data"))) {

base_path <- dirname(dirname(dirname(base_path))) # quarto -> by_timeSeries -> scripts -> root

}

events_path <- file.path(base_path, "data/macro_economy/market_events/events_2025.csv")

trends_path <- file.path(base_path, "data/macro_economy/market_events/trend_periods_2025.csv")

events <- read_csv(events_path, show_col_types = FALSE) %>%

mutate(date = as.Date(date))

trends <- read_csv(trends_path, show_col_types = FALSE) %>%

mutate(

start_date = as.Date(start_date),

end_date = as.Date(end_date)

)

# Display events

events %>%

select(date, market, category, event_label) %>%

head(10)# A tibble: 10 × 4

date market category event_label

<date> <chr> <chr> <chr>

1 2025-01-15 US INFLATION CPI Cooled

2 2025-01-24 JP MONETARY_POLICY BOJ Hike 0.5%

3 2025-01-29 US MONETARY_POLICY FOMC Hold

4 2025-03-03 US TARIFF Tariff Shock

5 2025-04-03 BOTH TARIFF Reciprocal Tariffs

6 2025-04-04 US TARIFF Tariff Shock Week

7 2025-04-08 JP TARIFF Nikkei Rebound

8 2025-04-09 BOTH TARIFF 90-Day Pause

9 2025-04-10 BOTH TARIFF Post-Pause Reversal

10 2025-05-13 BOTH TARIFF US-China Truce # Load S&P 500 from FRED parquet

# Use same base_path as events data

sp500_path <- file.path(base_path, "data/macro_economy/fred/SP500.parquet")

if (file.exists(sp500_path)) {

sp500 <- arrow::read_parquet(sp500_path) %>%

mutate(date = as.Date(date)) %>%

filter(date >= "2025-01-01", date <= "2025-12-31") %>%

rename(sp500 = value)

} else {

# Fallback: generate sample data

sp500 <- tibble(

date = seq(as.Date("2025-01-01"), as.Date("2025-12-31"), by = "day"),

sp500 = 5800 + cumsum(rnorm(365, 0, 30))

)

}

# For Nikkei, we'll use a simulated pattern based on events

# In production, use quantmod::getSymbols("^N225")

nikkei <- tibble(

date = seq(as.Date("2025-01-01"), as.Date("2025-12-31"), by = "day"),

nikkei = 38000 + cumsum(rnorm(365, 0, 400))

)

# Merge data

index_data <- sp500 %>%

left_join(nikkei, by = "date") %>%

drop_na()

head(index_data)# A tibble: 6 × 3

date sp500 nikkei

<date> <dbl> <dbl>

1 2025-01-02 5869. 38137.

2 2025-01-03 5942. 38087.

3 2025-01-06 5975. 38160.

4 2025-01-07 5909. 37838.

5 2025-01-08 5918. 37448.

6 2025-01-10 5827. 37962.Exploratory Analysis

Let’s examine the trend periods and major events:

# US Trends

trends %>%

filter(market == "US") %>%

select(start_date, end_date, trend_type, trigger_event)# A tibble: 8 × 4

start_date end_date trend_type trigger_event

<date> <date> <chr> <chr>

1 2025-01-01 2025-03-02 UP Post-2024 Rally

2 2025-03-03 2025-04-08 DOWN Tariff Shock

3 2025-04-09 2025-04-09 UP 90-Day Pause

4 2025-04-10 2025-05-12 DOWN Tariff Uncertainty

5 2025-05-13 2025-09-16 UP US-China Truce

6 2025-09-17 2025-11-12 UP Fed Easing Cycle

7 2025-11-13 2025-12-09 DOWN Rate Cut Doubts

8 2025-12-10 2025-12-31 UP Year-End Rally # Major events by category

events %>%

count(category, sort = TRUE)# A tibble: 5 × 2

category n

<chr> <int>

1 TARIFF 7

2 MONETARY_POLICY 6

3 RATES 3

4 INFLATION 2

5 GEOPOLITICAL 1Visualization

Main Chart: S&P 500 with Events and Trends

# Filter US trends

us_trends <- trends %>% filter(market == "US")

# Filter US/BOTH events

us_events <- events %>%

filter(market %in% c("US", "BOTH")) %>%

filter(!is.na(sp500_change))

# Create main visualization

p <- ggplot() +

# Trend shading

geom_rect(

data = us_trends,

aes(

xmin = start_date, xmax = end_date,

ymin = -Inf, ymax = Inf,

fill = trend_type

),

alpha = 0.15

) +

# S&P 500 line

geom_line(

data = index_data,

aes(x = date, y = sp500),

color = "#2563eb",

linewidth = 0.8

) +

# Event markers

geom_vline(

data = us_events,

aes(xintercept = date),

linetype = "dashed",

color = "#64748b",

alpha = 0.7

) +

# Event labels

geom_text(

data = us_events,

aes(x = date, y = Inf, label = event_label),

angle = 90, hjust = 1.1, vjust = 0.5,

size = 2.5, color = "#334155"

) +

# Styling

scale_fill_manual(

values = c("UP" = "#22c55e", "DOWN" = "#ef4444"),

name = "Trend"

) +

scale_x_date(

date_breaks = "1 month",

date_labels = "%b",

expand = c(0.02, 0)

) +

scale_y_continuous(

labels = comma_format(),

expand = c(0.1, 0)

) +

labs(

title = "2025 Market Events: S&P 500",

subtitle = "Trend periods (shaded) and major events (dashed lines)",

x = NULL,

y = "S&P 500 Index",

caption = "Source: FRED, Reuters | Created for TidyTuesday"

) +

theme_minimal(base_size = 12) +

theme(

plot.title = element_text(face = "bold", size = 16),

plot.subtitle = element_text(color = "#64748b", size = 11),

legend.position = "top",

panel.grid.minor = element_blank(),

plot.margin = margin(20, 20, 20, 20)

)

p

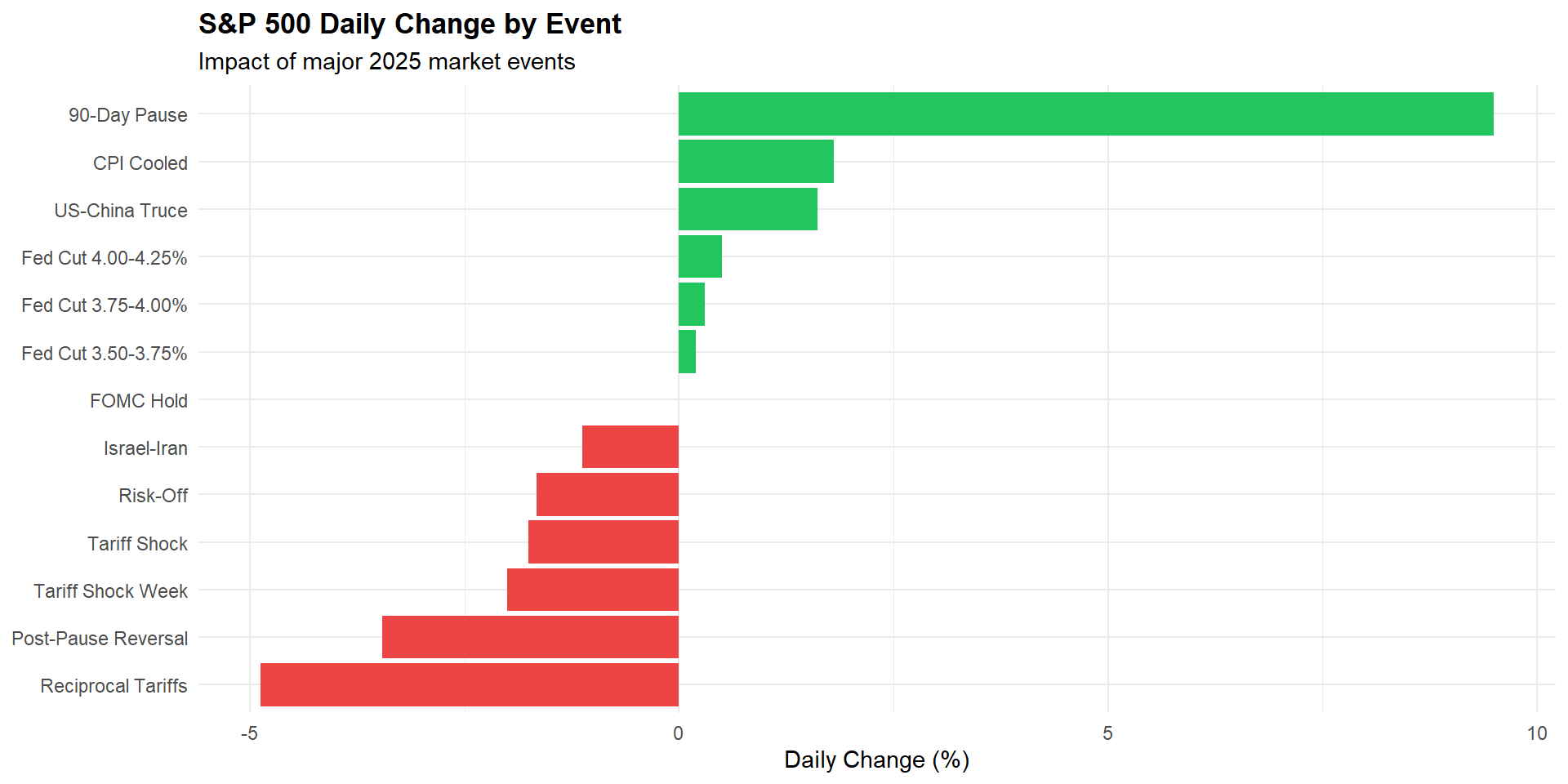

Event Impact Summary

# Bar chart of event impacts

events %>%

filter(!is.na(sp500_change)) %>%

mutate(

direction = ifelse(sp500_change > 0, "Positive", "Negative"),

event_label = fct_reorder(event_label, sp500_change)

) %>%

ggplot(aes(x = event_label, y = sp500_change, fill = direction)) +

geom_col() +

coord_flip() +

scale_fill_manual(values = c("Positive" = "#22c55e", "Negative" = "#ef4444")) +

labs(

title = "S&P 500 Daily Change by Event",

subtitle = "Impact of major 2025 market events",

x = NULL,

y = "Daily Change (%)",

fill = NULL

) +

theme_minimal() +

theme(

plot.title = element_text(face = "bold"),

legend.position = "none"

)

Key Findings

Tariff Shock (April 2025): The reciprocal tariffs announcement caused the largest single-day drop (-4.88%), followed by a historic +9.5% rally when the 90-day pause was announced.

Fed Easing Cycle: Three rate cuts (September, October, December) supported a gradual uptrend in the second half of 2025.

Geopolitical Events: The Israel-Iran escalation in June triggered a brief risk-off period with oil spiking +7%.

Trend Analysis: The year showed alternating patterns of sharp corrections followed by sustained rallies.

This post is part of the TidyTuesday weekly data visualization project.